05 Oct What to do if there are no recent comparables?

Occasionally, when I get to the research comparable sales step in the appraisal process, I’ll come across a situation where there has been no recent sales. In today’s active market, this rarely occurs, but this does happen from time to time. Recently I came across this situation completing an appraisal in a halfplex subdivision that had no sales over the past year. Maybe you’ve experienced this situation as well. The first thought is naturally “There are no recent sales, how can I support an estimated value?”

Here are a few ideas to help identify the appropriate comparables and support an estimated market value.

1) Research old, historic sales back in time and compare.

This is a very useful tool. Go back in time and find the last sale whether it’s 1 year, 2 year, etc. When we identify a historic sale in our subdivision, we can then compare this sale vs. other competing sales in surrounding subdivision at the time of this sale to capture and guide what competing subdivisions are most similar in appeal and price range. This demonstrates market support, and moreover, not guessing what subdivisions to select comparables from.

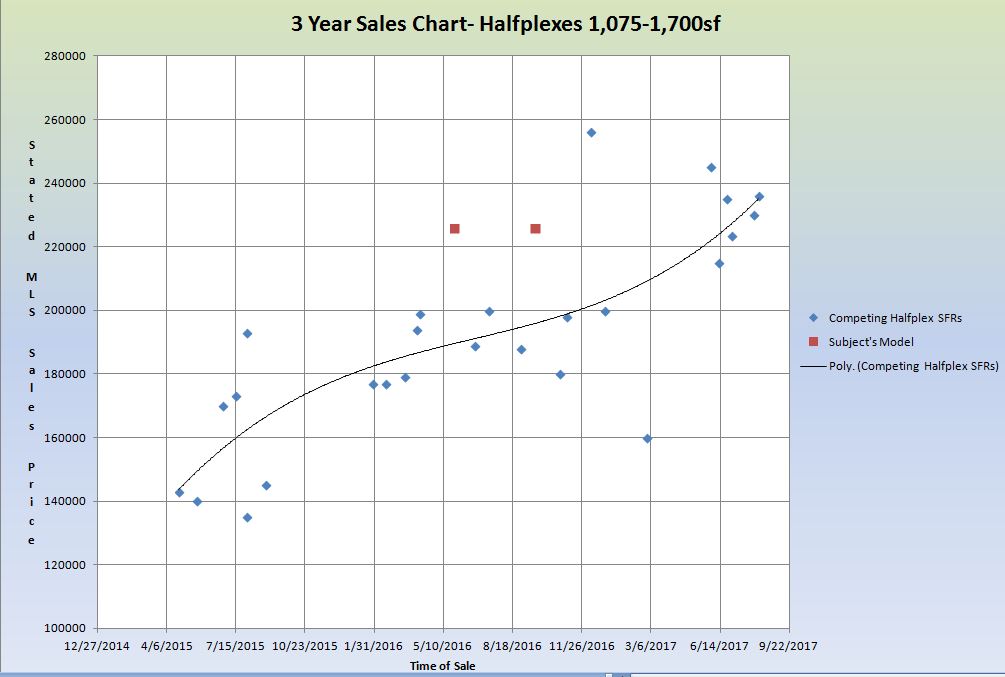

In my halfplex scenario mentioned above, I found two old sales of the subject’s model in the middle of 2016. Looking at the graph, these models sold at the high end vs. competing halfplex sales in other subdivisions (similar in size). The graph provides market support and is a fantastic visual in showing this.

Fast forward to present, I can pull recent sales in these competing subdivisions confidently knowing that the subject competes with these other halfplex sales based upon the historic data.

2) Analyze overall market trends to identify a time adjustment for older sales.

A time adjustment is a useful tool to apply to an old sale to use as a indicator to help suggest current market value. This can also be used to cross check the data noted above ( point #1). It’s prudent to look at both segmented data (comparables similar in size ) and overall market data (all sales) to identify trends and appreciation percentages.

In my scenario, when I ran the zip and neighborhood data, both demonstrated an increasing values from 2016 to 2017. Applying the time adjustment to older sales in the subdivision suggested a price range supported by the upward trend line of the graphs and recent closed sales.

Conclusion

In my opinion, based upon historic sales analysis and current market trends showing SFRs increasing over the past year, an estimated value range should fall just above the recent closed sales.

I hope you find this breakdown useful on how I approach scenarios similar to the above. Looking at historic data can give us context and guidance in estimating a value when there no recent closed sales.

Office: 530-878-1688

Disclaimer: All information deemed reliable but not guaranteed. The information is meant entirely for educational purposes and casual reading only and is NOT intended for any other use. This information is NOT intended to support an opinion of value for your appraisal needs or any sort of value conclusion for a loan, litigation, tax appeal or other potential real estate or non real estate purpose. This appraiser is NOT a qualified home inspector and any tips are for informative purposes only. If you’d like to obtain and order an appraisal for your specific needs, please contact Bryan at 530-878-1688 for more information.

Sorry, the comment form is closed at this time.