20 Jul Real Estate Blog: Summer Market Recap

At the start of the year, I asked 4 questions that may impact real estate going into 2017. I can’t believe we are already 1/2 way through 2017 as this year has flown by. Generally, I have to admit, this year has taken me by surprise with some of the real estate trends and did not expect the overwhelming buyer demand in many areas.

I thought it’d be interesting to revisit some questions I posed in my January blog about 2017 and see what has occurred so far.

Questions from January Blog-

Will mortgage interest rates maintain, increase or pull back?

In January, the 30 year mortgage rate was hovering in the low 4’s. While there was some upward movement in early spring, the 30 year mortgage is currently below 4% at this time. While the fed has increased the federal funds rate in 2017 (as anticipated), mortgage rates do not necessarily follow this trend as mortgage rates are lower than January. While mortgage rates fluctuate, it seems mortgage rates even in the low 4’s is not enough to slow down the market based upon my observations.

Will higher rates cause a slowdown in prices? Will inventory shift from shortage to balanced?

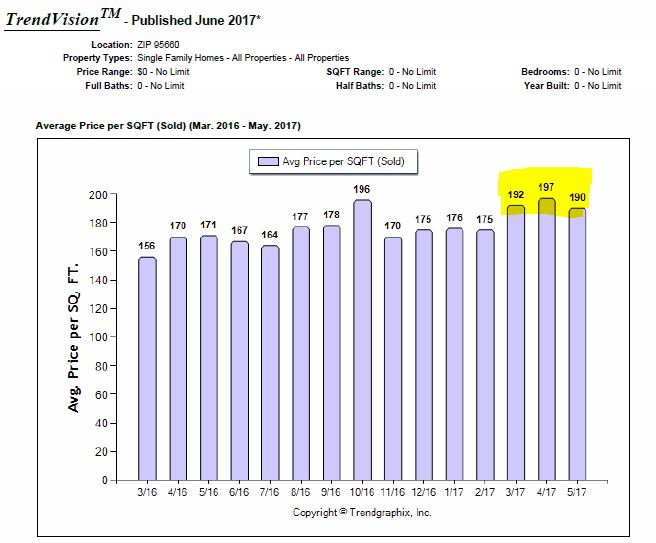

These two questions go hand in hand. I think the upward trend in prices in many areas has surprised me the most. The data going into 2017 seemed to suggest and indicate a leveling and stabilization of home values in many areas. As spring developed, there were many neighborhoods that jumped in prices quickly. See graph from zip code 95660 (North Highlands) and notice the jump in price per SF over a 3 month stretch.

In some cases, there was overwhelming demand with multiple offers (one house I appraised had 10 offers for example) vs. little to no inventory. In my analysis, some sales contracts are adding verbiage of buyer covering all or a portion of the difference between contract price and appraised value. In some cases, appropriate time adjustments still could not support the contract price.

I have began to see some leveling out in some areas over the past month it seems but prior historic trends may not apply in the current market.

Rental Rents Increasing-

Alongside buyer demand, there has been very high demand for rentals. Rents have increased excessively in many areas due to exceeding tenant demand with a lack of rental supply available. In Roseville, rent for a 1500sf home jumped from $1,595 to $1,950 in one instance. In some cases, leases are up and sellers have decided to sell the property. If a tenant has been in a lease agreement over a year or beyond, there will be likely a rude awaking of current market rents (as in the case above). If anybody has any other experiences, I’d love to hear about them.

I wish everybody a great rest of summer!

Office: 530-878-1688

Disclaimer: All information deemed reliable but not guaranteed. The information is meant entirely for educational purposes and casual reading only and is NOT intended for any other use. This information is NOT intended to support an opinion of value for your appraisal needs or any sort of value conclusion for a loan, litigation, tax appeal or other potential real estate or non real estate purpose. This appraiser is NOT a qualified home inspector and any tips are for informative purposes only. If you’d like to obtain and order an appraisal for your specific needs, please contact Bryan at 530-878-1688 for more information.

Sorry, the comment form is closed at this time.