21 Apr Real Estate 1st Quarter 2015 Overview: Placer, Sacramento, Nevada Counties

As a sports enthusiast, one time of year that I love following is college basketball’s march madness. I’m not even a huge college basketball fan, but I enjoy following the bracket and taking part in a few competitions among friends for fun. The format of the tournament is as great as it gets from a sports stand point with the frenzy and excitement it brings as 64 teams play in a win or go home scenario. The same type of frenzy is happening so far in 2015 regarding the real estate markets in placer, sacramento and nevada counties. Perhaps many potential buyers who were on the side line in 2014 are back enthusiastically in the housing hunt. The overall market is seemingly feeling like the heated 2013 market again with lower days on market, multiple offers above list prices, pending sales after one weekend of showings, etc. As I’ve talked about in prior posts, interest rates have been a real driving force in 2015 which has put downward pressure on inventory and upward pressure on prices in various areas.

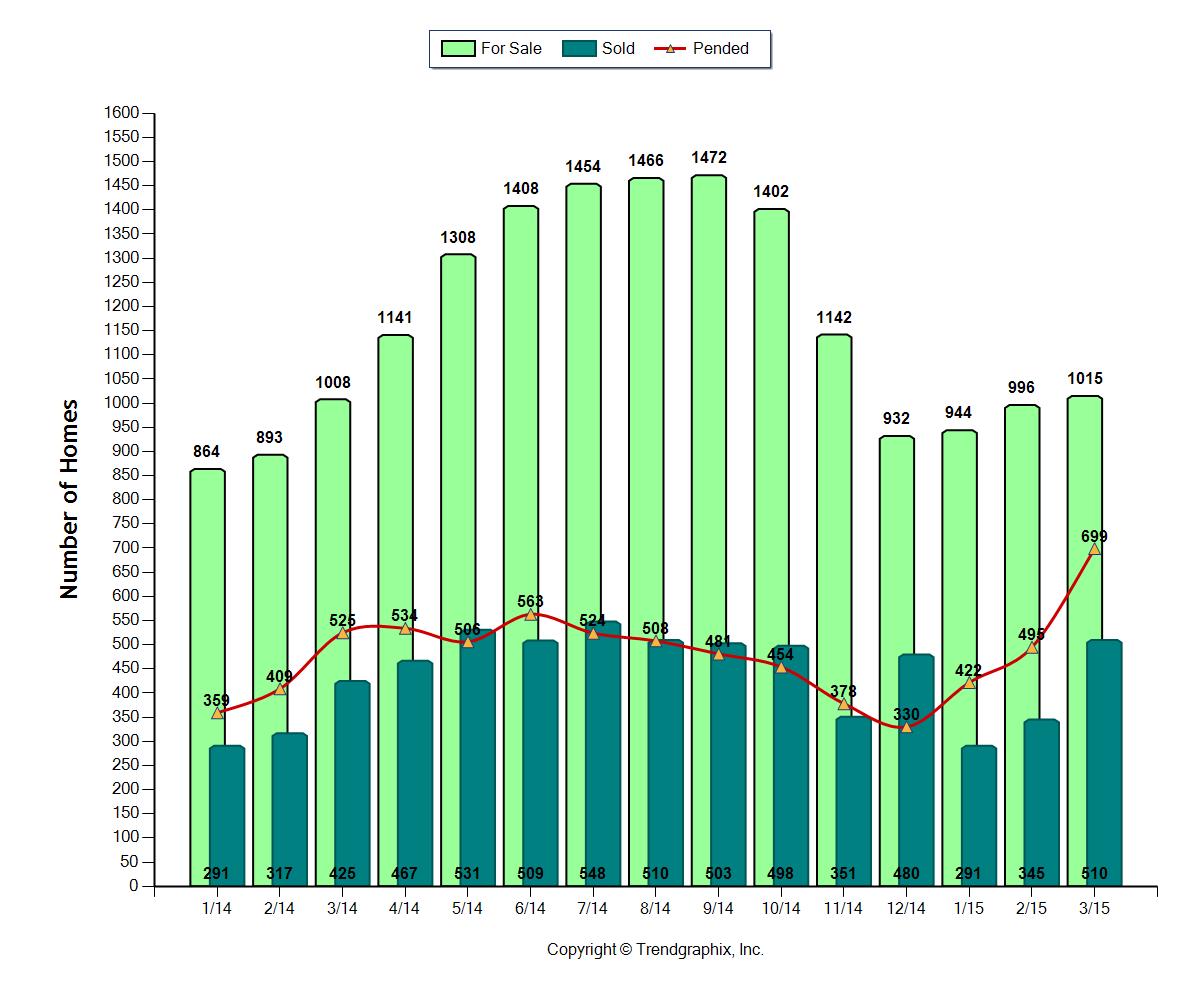

Here are some quick stats Sacramento, Placer and Nevada counties.

Sacramento County

1) Total active listings are down 3.1% compared to the same quarter last year.

2) Total sales are up 3.2% compared to the same quarter last year

3) Pending sales are up a significant 14.4% during this time frame.

4) The median, average and price per SF are also showing an upward trend vs. 1 year ago.

Placer County

1) Total active listings are up 6.8% compared to the same quarter last year.

2) Total sales are up 11% compared to the same quarter last year

3) Pending sales are up a significant 25.1% during this time frame.

4) The median, average and price per SF are also showing an upward trend vs. 1 year ago.

Nevada County

1) Total active listings for sale are up less than 1% compared to the same quarter last year.

2) Total sales are up 2.4% compared to the same quarter last year

3) Pending sales are up a significant 35.9% during this time frame.

4) The median, average and price per SF are also showing an upward trend vs. 1 year ago.

Key Takeaways-

As one can see, the state that jumps off the page is that pending sales are up considerably compared to the first quarter of 2014. Placer and Nevada counties especially show a huge increase in pending sales. I find it interesting particularly in Nevada county that the number of homes for sale is relatively the same as last year, but pending sales are up 35.9%. The market is moving at a frantic pace as far as pending sales go.

Looking back to 2014, I think as real estate inventory became somewhat stagnant and began to increase with many buyers on the sidelines, that many (both higher ups and public) were quietly concerned about what direction the real estate market was heading. One way to address this concern in the interim and give the real estate market a shot of adrenaline is to drop mortgage rates below 4% again. I’m not going to comment on the long term positive or negative implications on how this may impact both the real estate market and overall economy, but dropping of mortgage rates is seemingly a direct effort to continue keeping the real estate markets moving vibrantly and push buyers back into the market in the short term. With the number of pending sales up significantly, the data over the next quarter should see a seasonal upward tick in median, average and price per SF trends once these pending sales close. And on the mortgage refinance side, many owners are refinancing again and ultimately lowering their mortgage payments freeing up extra money to either save or spending back into the economy, which I believe is another desired affect.

Appraisal Tip: When installing carbon monoxide (CO) detectors, make sure to install CO detectors on all levels in multi-story homes and also in basements. For example, often times at an inspection, there will be a CO detector installed only on one level of a 2-story home and will at times be conditioned by the lender to have installed on both levels prior to loan closing.

Certified Real Estate Appraiser

Auburn Phone: 530-878-1688

www.AdvantageAppraisalsCa.com

Disclaimer: All information deemed reliable but not guaranteed. The information is meant entirely for educational purposes and casual reading only and is NOT intended for any other use. This information is NOT intended to support an opinion of value for your appraisal needs or any sort of value conclusion for a loan, litigation, tax appeal or other potential real estate or non real estate purpose. This appraiser is NOT a qualified home inspector and any tips are for informative purposes only. If you’d like to obtain and order an appraisal for your specific needs, please contact Bryan at 530-878-1688 for more information.

Sorry, the comment form is closed at this time.